Payment tools

to grow your business

Accept payments and move money globally with the world's most flexible and scalable payment APIs.

Book a personalized demo and get early access to our API documentation

Choose your integration

Select the service that best fits your needs

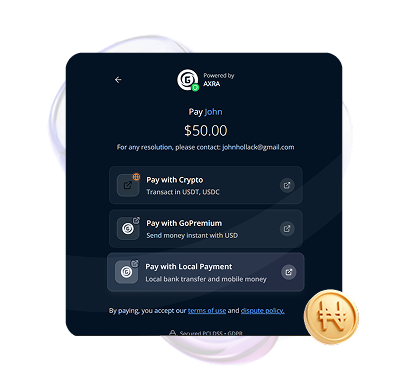

Collection Service

Hosted payment pages with your branding

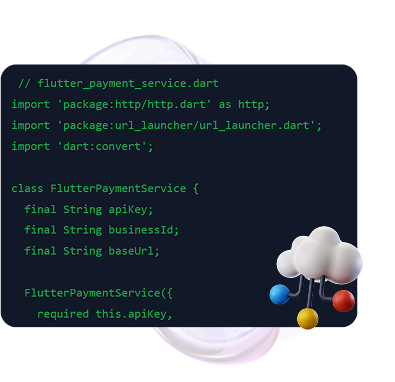

Code example

Collection Service

Hosted payment pages with your branding

// Create a payment collection page

const response = await fetch('/api/collection', {

method: 'POST',

headers: {

'Authorization': 'Bearer your-api-key',

'Content-Type': 'application/json'

},

body: JSON.stringify({

businessId: 'your-business-id',

amount: 5000,

currency: 'USD',

customerName: 'John Doe',

customerEmail: 'john@example.com',

description: 'Payment for services'

})

});

const { paymentUrl } = await response.json();

// Redirect customer to: /paymentUrlPCI DSS Compliant

Bank-level security with end-to-end encryption and fraud protection

Global Reach

Accept payments from 150+ countries with local payment methods

99.9% Uptime

Enterprise-grade reliability with automatic failover and monitoring

A Complete

Payment Orchestrating

Platform

Subscription Services

Have a marketplace with various vendors? We can manage your payments seamlessly.

Multi Vendor Marketplace Usage

Have a marketplace with various vendors? We can manage your payments seamlessly.

Fast E-commerce Checkouts

Use our shopify or woo commerce integration, with less rates and faster checkout time.

Developer Friendly SaaS Applications

Whether React or Node.js, our API service caters to all SaaS platform needs.

Seamless with Mobile Apps

Use our API service seamless across your mobile app. Collect subscriptions easily.

Education Services Payment

Collect payments for your education services seamlessly.

Event Ticketing Services

Collect payments for your event ticketing services seamlessly.

Use With Freelance Platform

Receive payments for your freelance services instantly.

Healthcare Services Payment

Receive payments for your healthcare services instantly.

Donation Checkouts

Use our API service to collect payments for your donation services seamlessly.

We are the perfect solution

to fit all of your business needs

GoPremium powers seamless payments worldwide, helping you scale faster and serve customers with confidence.

Robust Secure Payment API

Built-in security features like PCI-DSS compliance, tokenization, 3D Secure, and real-time fraud monitoring help protect sensitive data and reduce risks.

Frictionless Multi-Currency Support

Payment APIs enable seamless handling of global transactions by supporting multiple currencies (USD, EUR, GBP, NGN, etc.) and enabling upfront local pricing, improving customer trust and conversion.

Developer-Friendly Integration & Automation

APIs are designed for quick implementation—granting access to features like tokenization, recurring billing, virtual accounts, and payouts—which reduces complexity, accelerates launch, and streamlines operations.

Real-Time Insights & Orchestration

Integrating APIs allows businesses to unify payment channels—cards, bank transfers, wallets—under one dashboard, offering real-time monitoring, dynamic routing for better success rates, and efficient error handling.

Onboarding Timeline

A streamlined process to get you processing payments quickly and securely.

- 1

Application

Submit business information and required documentation through our secure portal.

- 2

Due Diligence

Comprehensive KYC and AML checks to ensure regulatory compliance and risk assessment.

- 3

Underwriting

Risk classification analysis and collateral requirements determination based on your business model.

- 4

Integration & Go-Live

API integration support, testing environment access, and production deployment assistance.

Typical onboarding takes 5–10 business days depending on business complexity and documentation completeness.

with our fast and reliable API

Schedule a Demo Call

Click to pick a time that works best for you and our representative will reach out to you.

Schedule Call

Integrate API

If you meet our requirements, We get you onboard and integrate the API.

Get Started

Pricing

Competitive rates, transparent fees, no hidden costs. Get started with enterprise‑grade payment processing today.

Pay‑as‑you‑go

Start free, scale as you grow with usage‑based billing.

Volume discounts

Custom pricing for high‑volume and enterprise merchants.

No setup fees

Transparent terms with no hidden or recurring platform fees.

Support & SLAs

Enterprise‑grade support with guaranteed uptime and dedicated account management.

24/7/365 Support

Round‑the‑clock assistance via email and live chat with expert payment specialists.

Dedicated Account Management

Personal account managers for high‑volume merchants with priority support channels.

99.9% Platform Uptime

Enterprise‑grade infrastructure with documented SLAs and transparent status reporting.

Compliance & Risk Management

Protecting the network from financial crime with comprehensive risk controls and regulatory adherence.

Prohibited Countries▾

Transactions from these countries are not permitted under any circumstances.

Restricted Countries - EDD Required▾

Enhanced Due Diligence (EDD) and additional documentation required for merchants from these regions.

Controlled Countries - Whitelisted Only▾

Whitelisted merchants only with active monitoring and enhanced risk controls.

Regulatory Adherence▾

Full compliance with international standards and regional data protection requirements.

Contact us for the latest country classification updates and specific merchant requirements.

Stay Ahead of Fraud,

Stay Ahead in Business.

From checkout to settlement, every step protected with enterprise-grade security.

Get Started